Employee Benefits Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10546

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Employee Benefits Category Overview

“The employee benefits category’s growth is driven by the increased competition among employers to hire and retain talent.”

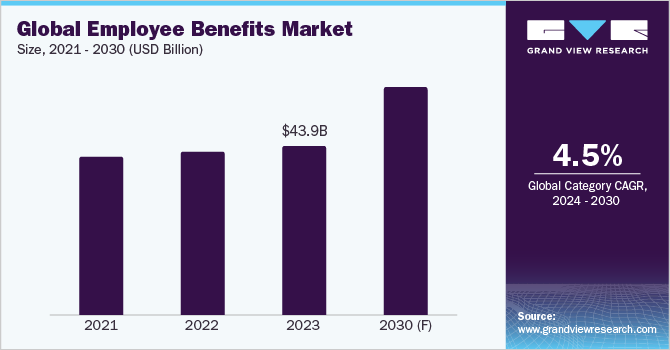

The employee benefits category is expected to grow at a CAGR of 4.5% from 2024 to 2030. This category is expanding as a result of increased talent competition, rising healthcare expenses, and shifting workforce demographics. Employee perks are a crucial component in luring and keeping employees in an environment where employers are vying for the best talent. To be competitive, businesses are providing more extensive and varied benefit packages. Employees are looking for employers who would cover the rising healthcare costs. Offering health benefits like medical, dentistry, and vision insurance can help firms stand out from the competition. Older workers are looking for retirement advantages like 401(k) plans and pension plans as the workforce gets older. On the other hand, younger workers are seeking more flexible benefits including aid with school loan repayment and mental health benefits. Competitive employee perks assist organizations in attracting and retaining top employees. This is especially significant in businesses where skilled individuals are in great demand. Worker happiness and morale can be improved by providing extensive perks to workers, which can lead to greater efficiency and commitment. Many worker aids are tax-deductible, which can save firms money.

The global employee benefits category size was valued at USD 43.99 billion in 2023. Due to its financial advantages, the voucher system is advantageous for both companies and their staff. By providing a voucher, employers can opt out of making social insurance adjustments while still providing tax advantages to their staff. Additionally, it has been noted that such activities boost staff productivity. Employers thus play a significant role in increasing staff engagement in firms by implementing perks, aiding the expansion of the global employee benefits category. According to a report named ‘2022 EBRI Financial Wellbeing Employer Survey’, published by the Employee Benefit Research Institute (EBRI), in 2022, the percentage of American employers interested in implementing financial well-being programs in their organizations increased from 34% in 2021 to 54% in 2022. Employers who did not already offer financial wellness initiatives stated they were actively implementing a program rather than being interested in delivering one. Between 2020 and 2022, the percentage actively implementing climbed from 12% in 2018 to between 25% and 34% respectively.

According to the 2023 report published by Mercer, welfare technology is becoming more important in the workplace, and organizations around the world are reacting, with 69% of HR managers wanting to expand investment in digital benefit technologies to enhance the administration of benefits and management in the next 1-3 years. However, the low staff engagement rate and high cost are impeding category expansion. Despite providing a variety of perks, some workers could choose not to utilize them owing to a lack of knowledge, lack of interest, or other factors. Offering more complete aid packages may be difficult as a result of low participation rates and underuse of benefits. Employers, especially small enterprises, may find it expensive to offer benefits to their workers. Welfare expenses like healthcare, retirement plans, and wellness programs may be very expensive, especially for companies with thin profit margins.

Supplier Intelligence

“How can the nature of the employee benefits category be best described? Who are some of the key players?”

The global employee benefits category is fragmented with the presence of several large, medium, and small-sized service providers. Large global players are strategically collaborating with small regional players to enter emerging markets such as APAC and Eastern Europe. These players are constantly seeking ways to enhance their offerings, such as through strategic partnerships and regional expansion. For instance:

-

In March 2023, Empyrean Benefit Solutions, a U.S.-based subsidiary of Securian Financial, bought Enspire, an employee communication and engagement platform, to provide American businesses with employee benefit-related administration tools and sympathetic support services.

-

In December 2022, by acquiring the employee benefits division of the UK-based Creative Benefit Solutions Limited, PIB Group Ltd. (PIB) enhanced its employee benefits solutions business.

-

In August 2021, Up Group purchased Leeto to improve its offerings by adding a complementary digital service to its current offerings, including a platform that enables employees to access their benefits.

Key suppliers covered in the category:

-

Aon Hewitt

-

Mercer

-

Fidelity Inc.

-

Met Life Inc.

-

Aetna Inc.

-

Benify

-

Wills Tower Watson Plc

-

Marsh & McLennan Companies, Inc.

-

Gallagher & Co.

-

Axa Group

The bargaining power of buyers in this category is high. This is because:

-

Many suppliers need to provide employee benefit services, creating a large market for these services, which gives buyers more bargaining power.

-

The products and services offered by providers are relatively standardized. This means that buyers have more options to choose from.

-

Switching from one provider to another is relatively easy. This means that buyers are not locked into any one provider.

Pricing and Cost Intelligence

“What is the total cost associated with providing employee benefits? Which factors impact the service prices?”

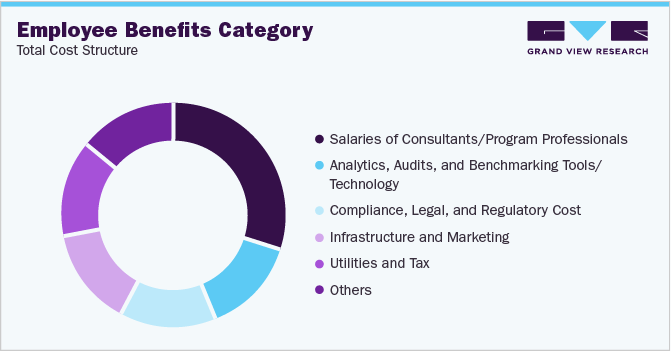

The major costs incurred in providing these services are salaries of consultants’ or program professionals, analytics, audits, and benchmarking tools or technology, compliance, legal, and regulatory cost, infrastructure and marketing, and utilities and tax. In this industry, salaries are the largest cost component followed by platforms and technology needed to support the professionals. Platform cost can be calculated per head or in a tiered -package way or on a subscription basis. Subscription costs can start as low as USD 10 – 15 per person. Employee benefits often comprise salary packages that include extras like health insurance, retirement savings programs, paid vacation days, and so forth.

Employers are increasingly interested in expanding their coverage to include dependents. Employers in collaboration with these service providers are opting for large corporate schemes. To control costs and to reduce cost per member, these category service providers are asked by clients or firms to introduce excess charges or increase employee eligibility in their scheme structures.

The chart below shows a breakdown of the cost structure associated with employee benefits along with major cost components:

Fixed-fee pricing and per-employee per-month pricing are two of the most widely utilized pricing schemes. However, these are only used for short, straightforward projects. Depending on the project's complexity, outcome-based or value-based pricing is also used. This price scheme is mostly used for customers who have a greater number of employees and a higher level of complexity in managing and formulating employee benefits.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for employee benefits services?”

India, the Philippines, Mexico, Vietnam, and China are some of the best countries for sourcing in this category. These countries provide a huge pool of qualified and English-speaking workers, as well as low labor costs and plentiful resources. Because of its enormous pool of competent and English-speaking personnel and low labor costs, India is one of the most favored destinations for outsourcing employee benefit services. Another popular choice is the Philippines, which has a comparable manpower and pricing structure. Mexico is a nearshore country to the United States, making it a viable alternative for enterprises that wish to avoid the time zone and cultural variations that might accompany outsourcing to countries further away. Vietnam is a fast-developing country with a burgeoning economy, and labor prices remain low. China boasts the world's largest labor force. When compared to the U.S., labor costs in China are lower by 25% to 40%.

In terms of employee benefits sourcing intelligence, vendors opt for a hybrid/bundled outsourcing model. Due to the time, effort, and difficulty of self-insuring, businesses frequently choose third-party employee benefit plans. As decision-making power is limited and the provider treats each member equally, this decreases liability and upfront costs. Administration requirements are frequently confined to onboarding and offboarding members, claims applications, and performance evaluation. This requires minimal investment in support resources while providing the provider with substantial power in terms of information, data, experience, and guidance. Outsourcing benefits also minimize HR departments' exposure to the employee benefits industry. However, this technique necessitates a large investment in firm support resources. It has been discovered that implementing an offshore strategy can assist a corporation in reducing employment costs by more than 50 - 60%.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Employee Benefits Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Employee Benefits Category Growth Rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

10% - 12% (annual) |

|

Pricing Models |

Value-based pricing model, fixed-fee pricing model, per-employee per month pricing model |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Customization & flexibility, work benefits, financial benefits, health-related benefits, lifestyle-related benefits, employee experience, service, support, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Aon Hewitt, Mercer, Fidelity Inc., Met Life Inc., Aetna Inc., Benify, Wills Tower Watson Plc, Marsh & McLennan Companies, Inc., Gallagher & Co., Axa Group |

|

Regional Scope |

Global |

|

Historical Data |

2021 - 2022 |

|

Revenue Forecast in 2030 |

USD 59.9 billion |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global employee benefits market size was valued at approximately USD 43.99 billion in 2023 and is estimated to witness a CAGR of 4.5% from 2024 to 2030.

b. The increased competition among employers to hire and retain talent, and rising focus on maintaining work-life balance among employees is driving the growth of this category.

b. According to the LCC/BCC sourcing analysis, China, the Philippines, Mexico, Vietnam, and India are the ideal destinations for sourcing employee benefits.

b. This category is fragmented with the presence of many large players competing for the market share. Some of the key players are Aon Hewitt, Mercer, Fidelity, Met Life Inc., Aetna Inc., ACS S.A., Wills Tower Watson, Marsh & McLennan Companies, Inc., Gallagher, Axa S.A.

b. Insurance, legally required benefits, paid leave, supplemental pay, and retirement & saving are the cost components associated with this category.

b. Identifying risk parameters, legal compliance and fairness in execution, and developing appropriate SOPs are some of the best sourcing practices in this category.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.